Business Overview

Copart is a global leader specializing in online vehicle auction and remarketing services. They resell used, wholesale, and salvage title vehicles on their platform.

Their business revolves around their online auction platform, Virtual Bidding Third Generation (VB3), which allows for the buying and selling of vehicles. The platform is similar to eBay in its functionality, and acts as an intermediary between buyers and sellers. The buyers consist of vehicle dismantlers, rebuilders, dealers, exporters, and the general public. The sellers primarily consist of insurance companies, but also include dealers, individuals, charities, banks, rental businesses, financial institutions, and fleet operators.

In conjunction with their digital auction service, Copart provides other key services such as title processing with regard to salvage titles and transfers of ownership, vehicle storage and transportation, valuation tools using proprietary software and AI to assess salvage values and optimize operations, parts recycling, and specialty auctions for motorcycles, RVs, boats, and heavy equipment.

Copart was founded by Willis Johnson in 1982, and has grown from a single salvage yard in California to a multibillion dollar organization with over 250 locations in 11 countries (United States, United Kingdom, Germany, Brazil, Canada, United Arab Emirates, Spain, Finland, Ireland, Oman, and Bahrain). The business has over 265,000 vehicles up for auction every day on its website and currently has over 1 million members – buyers – across over 190 countries.

In addition to these 11 countries, Copart has lounges in Ukraine, Bulgaria, El Salvador, Georgia, Nigeria, Honduras, Azerbaijan, and Armenia. These lounges assist customers with the buying process from searching for vehicles to shipping to their countries. Even if there isn’t a lounge in a particular location, they have a dedicated international team that will help those customers. This provides a footprint for Copart to expand in more emerging markets, where demand is high, but Copart still doesn’t have the infrastructure in place yet to operate yards.

Moat & Competitive Advantage

1. Network Effects & the VB3 Digital Platform

At the heart of Copart’s moat is its proprietary online auction platform, VB3, which enables real-time, multi-yard bidding and global inventory access. Buyers can bid on vehicles across Copart’s entire network, increasing liquidity and efficiency. Sellers benefit from higher recovery values, making Copart attractive to insurance companies and other institutional partners.

This creates a positive feedback loop: buyers want platforms with large inventory, and sellers want platforms with large buyer pools. As more participants join, Copart becomes more valuable—establishing a strong network effect.

Copart is not the only company offering online vehicle auctions, but it is the largest, most vertically integrated, and technologically advanced. Its primary competitor, IAA (owned by Ritchie Bros.), moved fully online years after Copart, and is generally seen as having a less efficient operating model and weaker international presence.

2. Technology Integration & High Switching Costs

VB3 is not just a marketplace—it is deeply integrated with proprietary tools that increase operational efficiency and customer stickiness:

AI-powered valuation tools assist insurers in pricing salvage vehicles.

Copart 360 enables remote imaging and inspection.

Machine learning algorithms help sellers set minimum bid prices.

Logistics planning tools optimize storage and transport.

Title and document processing, including integrations with DMVs in multiple U.S. states.

Because the system collects detailed bidding and pricing behavior data, it continuously improves its own valuation tools—creating a feedback loop that reinforces its value to high-volume sellers and makes switching platforms costly and unattractive.

3. Land Ownership & Physical Footprint

Copart owns the majority of its 250+ storage yards, amounting to over 8,500 acres of land. This offers multiple advantages:

Lower long-term costs compared to leasing

Avoidance of renewal risks and rent escalations

Flexibility to expand capacity without zoning delays

Salvage yards face significant zoning and permitting challenges, often taking years to establish. This creates high barriers to entry for competitors who would need to secure both land and regulatory approval—something Copart already possesses at scale.

Additionally, Copart’s extensive footprint allows it to quickly respond to catastrophic events. For example, following Hurricane Ian in 2022, Copart was able to store and auction thousands of flood-damaged vehicles in South Florida thanks to its strategic land holdings and catastrophe-trained personnel.

Its real estate holdings are worth $2.4 billion, but much of this value is understated on the balance sheet due to accounting at historical cost. This hidden value acts as a financial buffer and collateral base for future growth or emergency liquidity.

4. Capital-Light, Fee-Based Model

Copart typically acts as an intermediary, not a principal—it does not take ownership of the vehicles it auctions. Instead, it earns fees from both buyers and sellers, as well as additional revenue from services like title processing, storage, and transportation.

This capital-light model results in:

Minimal inventory risk

High margins

Exceptional returns on invested capital (ROIC)

Strong operating leverage as transaction volumes scale

Even during downturns, demand for salvaging remains due to accidents and natural disasters. Since Copart earns fees per transaction without tying up capital, it remains resilient in bear markets. Its base of repeat sellers (e.g., insurers) creates recurring, sticky revenue streams that contribute to predictable cash flow.

Growth Drivers

1. Rising Total Loss Frequency

As modern vehicles become more advanced, especially those with ADAS and EV components, they will become more costly to repair. Insurance companies will total more vehicles as repair-to-value ratios increase, resulting in higher volumes for Copart.

2. International Expansion

Copart is growing in markets such as the UK, Germany, Brazil, Canada, United Arab Emirates, Spain, Finland, Ireland, Oman, and Bahrain. Many countries are early in the adoption of salvage auctions, so there is a long runway for growth ahead.

3. Expanding Buyer Base

There are over 1 million global buyers across over 190 countries. As global wealth increases, there will be increased access to Copart’s platform due to its computed and mobile-based bidding system, multilingual interface, and real-time auctions.

Many international buyers – particularly from regions such as Africa, Latin America, and Eastern Europe – are willing to pay more for salvage vehicles because labor costs are lower, safety standards are more lenient, and there is a strong demand for used vehicles. US imports are especially attractive due to favorable currency dynamics among other factors. As of now, over 30% of US-origin vehicles sold by Copart are purchased by non-US buyers.

As more international buyers compete on Copart’s platform, sale prices rise, which increases recovery rates for sellers (mainly insurance companies) and fee revenue for Copart. As stated earlier, this creates a network effect where higher prices attract more sellers, which pushes more inventory into Copart’s ecosystem.

Management Overview

Founder

Willis Johnson founded Copart in 1982, and served as CEO until 2010. He is currently the Chairman of the Board. His influence continues through his son-in-law, Jayson Adair. Less than 15% of Johnson’s total compensation is a salary. The rest is a blend of mostly stock options along with some non-cash benefits such as personal use of the company car and aircraft.

Executive Leadership

Jayson Adair has been with Copart since 1989. He worked his way up from being vice president of sales and operations to becoming the CEO from 2010 to 2022. From 2022 to 2024, he served as co-CEO alongside Jeffrey Liaw. As of 2024, Adair transitioned to the role of Executive Chairman. Since his tenure as CEO, Adair has been taking a $1 salary along with some non-cash benefits such as health insurance and personal use of the company car and aircraft. During his time as co-CEO, he received no stock options or awards.

Jeffrey Liaw has worked with Copart since 2016. He started as the CFO, and then transitioned to becoming the co-CEO alongside Adair in 2022. As of 2024, he is the CEO, while Adair transitioned to becoming the Executive Chairman. Prior to joining Copart, Liaw worked for TPG Capital Management, L.P., a private equity firm with over $70 billion in AUM, where he served as a Principal for 7 years. 43% of his total compensation is salary. The rest mostly consists of performance-based stock options and annual incentives.

Leah Stearns joined Copart in 2022 and has served as its Senior Vice President and CFO since then. Prior to joining Copart, Stearns worked in various executive roles at companies such as CBRE Group and American Tower Corporation. 13% of her total compensation is salary-based while the rest is a mix of stock options and equity awards.

Equity Compensation and Performance-Based Incentives

Executives and employees at Copart are granted performance-based stock options. While stock-based compensation is frowned upon by many in the investment community, Copart has a model where shareholder interests are aligned with company insiders. Firstly, Copart’s policy requires that executives maintain equity ownership that is greater than or equal to 3x their salary. In addition to that, these options vest over 5 years (20% annually), but they cannot be exercised unless the stock trades at 25% above the strike price for 20 consecutive trading days. Let’s take a look at some of the strike prices for executive stock options below:

Remember, we must apply a 25% premium to the option exercise prices listed. Based on the data above, Leah Stearns, the CFO, was the latest executive to receive stock options, and her hurdle rate is a stock price of $63.51. This price must be maintained for 20 consecutive trading days for her to be allowed to exercise those options. Otherwise, the options will expire worthless on each vesting date.

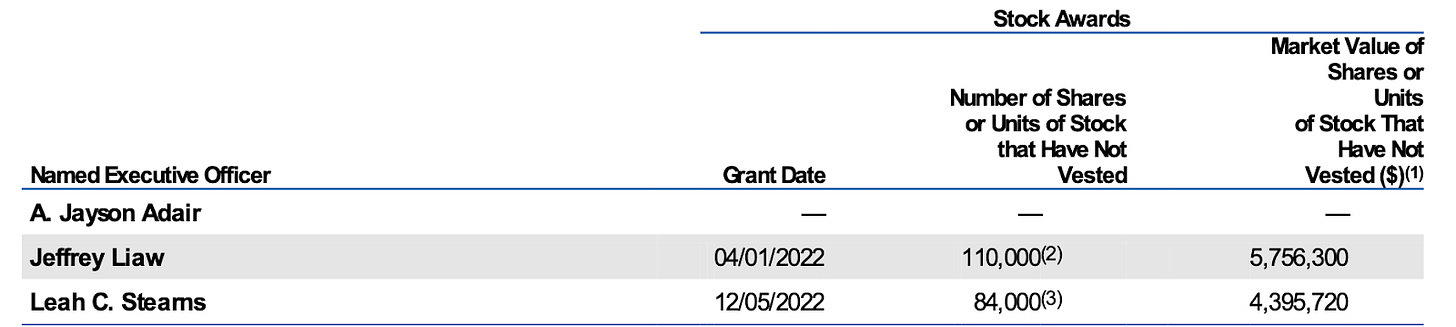

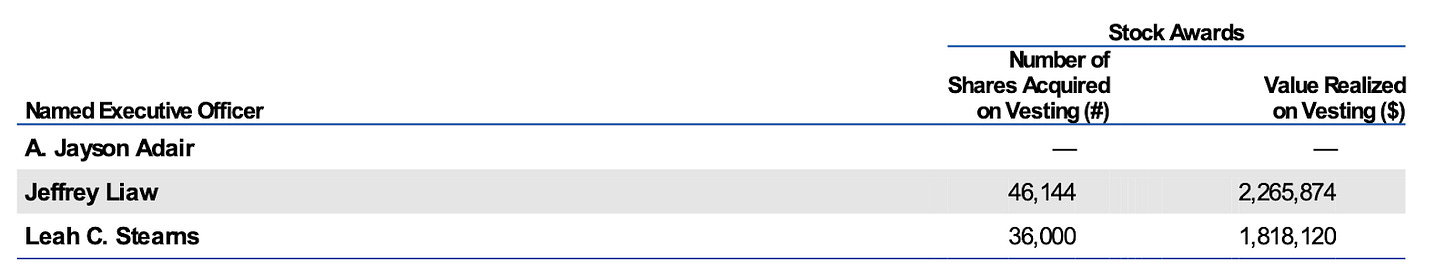

Liaw and Stearns are also the only executives to have received restricted share units (RSUs). These RSUs vest over 5 years, Liaw’s units are subject to a 10 year lock-up period.

Based on the data above, we can see that their RSUs are worth substantially more than their current salaries. At this time, Copart’s stock is trading at $48.38. The table below shows the relationship between the current value of these units and their salaries:

This structure ensures the majority of their compensation is tied to the stock’s long term performance.

Risks & Counterpoints

1. Zoning and Permitting Restrictions

Salvage yards are considered “nuisance use” properties and face lots of resistance from local communities, municipalities, and regulators. Copart already owns most of its land, providing it with a durable moat and competitive advantage. It also has a strong track record of working with local governments, as the business has been able to successfully open more facilities throughout the years, thereby increasing the durability of its moat. Copart is also an ESG-friendly company, as the only types of vehicles that enter its business are used models, which can be looked at as favorable by many regulators.

2. International Execution Risk

International expansion is a risk because it is unknown whether the international segment of the business will be similar to the US segment. International margins are lower than US margins due to Copart having a higher proportion of vehicle sale revenues (where Copart directly buys and sells the vehicle) than service revenues. This is because Copart has to deal with individual sellers more often in international markets, whereas insurers dominate the seller base in the US. In emerging economies, salvage infrastructure is still underdeveloped, which provides a long growth runway. Margins may be lower initially, but this is not a deviation from the core business model, as most revenue (over 80%) still comes from fees. As these markets mature and begin to adopt more standardized salvage processes, revenues will transition into a more fee-based structure as more relationships are built with institutional sellers. Copart has been able to successfully transition from vehicle sales to fee-based auctions in markets such as the US and UK. As international markets grow, there will likely be a similar shift toward more institutional rather than individual sellers.

3. Autonomous Vehicle (AV) Risk

A common risk that has been talked about in the market today is the AV risk. The rise of AVs can reduce accidents, which would lower the number of totaled vehicles – leading to significantly lower volumes for Copart. While AVs are advancing, full adoption is still decades away. In the interim, traditional vehicles will dominate the roads, and accidents will continue to occur. If there are AVs on the road alongside human-operated vehicles, the human drivers will still act irrationally at times, resulting in an accident for both the traditional vehicle and the AV.

Everything that happens between now and the full adoption of AVs can serve as a tailwind for Copart because vehicles will also continue to get more costly to repair as they become more advanced. This will increase the probability of these vehicles being totaled because less severe damage can be more expensive to repair, while vehicle values will go down quicker as technologies continue to advance faster and make older systems obsolete.

Once AVs arrive, they will first have to earn the trust of people. After that, it will take almost 13 years to get a fully autonomous fleet on the roads based on the current average age of cars.

Even after AVs are fully adopted, there is a likelihood that they will experience collisions and suffer from system malfunctions, especially in the early years of adoption. These vehicles may be even more costly to repair, which can increase total rates. They may even open up new salvage opportunities for high-value components such as sensors and cameras for Copart’s ecosystem.

Financial Highlights

1. Balance Sheet Strength

Zero debt.

$4.4 billion in cash, representing $4.54 net cash per share.

$2.4 billion in land, which accounts for 25% of total assets.

Cash and land together make up 70% of total assets.

Total assets exceed liabilities by more than 10x.

Cash and land are nearly 8x the company’s total liabilities, creating a substantial balance sheet cushion and flexibility.

2. Profitability & Capital Efficiency

Gross margin: 45%

Operating margin: 36%

Net margin: 32%

Free cash flow (FCF) margin: 26%

Margins have expanded significantly over the past decade, reflecting increasing operating leverage.

Return on invested capital (ROIC) has consistently exceeded 25% for the past 5+ years.

CapEx-to-revenue ratio is 14%, near its long-term median, with most spending directed toward land for capacity expansion, not maintenance.

3. Long-Term Compounding Track Record

EPS CAGR (10 years): 22%

Revenue CAGR (10 years): 14%

FCF CAGR (10 years): 19%

→ With a strong bias toward expansionary CapEx rather than sustaining operations.

4. Capital Allocation Discipline

326 million shares remaining in share repurchase authorization.

Copart uses a disciplined, opportunistic buyback strategy:

Buys back heavily in years when the stock is undervalued.

Follows with multi-year pauses focused on business reinvestment.

The current buyback lull may reflect a post-COVID focus on international growth and capacity expansion.

Valuation

NTM P/E Ratio: 31x

5-Year Mean: 32x

Using Benjamin Graham’s 2G rule, Copart would need to grow earnings at 15.5% annually to justify today’s 31x forward multiple. Analysts expect Copart to grow earnings by 13% annually from 2025 to 2028. I believe this is a fair assumption given the long-term growth prospects for Copart and their track record.

With a growth rate of 13%, Copart would end 2028 with $2.19 in EPS. Let’s assume we buy Copart today at $48.38 and examine its CAGR potential using different multiples:

As you can see, at the current valuation, we have to assume an ending multiple of 30x or more to have a double-digit compounded annual return. While I believe that Copart can reasonably trade at such a valuation due to the durability of its moat, high return on capital, and long growth runway ahead, I don’t want to rely on that assumption, as it leaves us with no margin of safety.

At $48.38, I believe Copart is trading at fair value. Copart is a business that rarely trades at a discount, which is why some investors have already begun buying shares. If I were to start a position at the current valuation, I would gradually buy in tranches and plan to add more on further drawdowns.

I consider Copart a compelling purchase below $45, where I can reasonably assume a double-digit return with a conservative 27x ending multiple—over 15% below the 5-year average.

Final Thoughts

Copart is a unique blend of durability, scalability, and efficiency. Its business model generates high margins and returns on capital while demanding little capital to scale its operations. With a long growth runway ahead and a deeply entrenched moat, the business has a structural advantage.

At current prices, the stock appears fairly valued. While it’s not inexpensive, it offers a good long-term return potential if expectations are met and the multiple remains steady. For investors who desire a margin of safety, Copart becomes more attractive below $45– where conservative assumptions support a double-digit return.

Disclaimer

This analysis of Copart is provided for informational purposes only and reflects the author’s personal research and opinion at the time of writing.

The Knight’s Edge is a personal publication created and maintained by Shivam Kashan. The content provided is for informational and educational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities.

All opinions and views expressed are solely those of the author and are based on information believed to be reliable at the time of publication. However, no representations are made as to the accuracy, completeness, or timeliness of the information. Readers should conduct their own independent analysis or consult a licensed financial advisor before making any investment decisions.

The publisher may hold positions in securities discussed, and those positions may change without notice. Forward-looking statements are speculative and subject to risks and uncertainties that could cause actual outcomes to differ materially.

By accessing this content, you agree to the terms of use and acknowledge that neither the publisher nor any of its affiliates are liable for any losses incurred as a result of reliance on this content. You also agree to resolve any disputes on an individual basis and waive rights to participate in class actions.

"Copart’s policy requires that executives maintain equity ownership that is greater than or equal to 3x their salary. In addition to that, these options vest over 5 years (20% annually), but they cannot be exercised unless the stock trades at 25% above the strike price for 20 consecutive trading days."

This disturbs me for the following reasons:

1. Executives should absolutely have equity stakes in the businesses they run, but not through gifted shares or free stock options. True alignment with shareholders comes when executives invest their own capital, just as they do at companies like Berkshire Hathaway and Constellation Software. A free option isn’t genuine skin in the game; it’s a one-sided bet, “heads I win, tails I don’t lose.”

2. The structure seems to be all wrong. It is a structure that creates incentives to pump the share price in the short-term, even if that's to the detriment of the company and its shareholders in the long-term. All sorts of games can be played - buying back overpriced stock to inflate per-share metrics, cutting necessary operating expenses, capitalizing costs that should be expensed, or stretching depreciation schedules. None of these things is good for the company or its shareholders - so this kind of structure is all wrong. It was exactly this kind of flawed incentive structure that contributed to the downfall of IBM under Lou Gerstner - once the world's most valuable company and now a shadow of its former self - a cautionary tale of how the wrong incentives can spectacularly backfire.

Smashing it out of the park with your first write up!